同一个类 cannot be cast to_留学热门assignment之 税收筹划类essay

税法和税务筹划一直以来都是热门的行业,由于近些年对于税务人才的需求越来越大,税法专业成为了当下最火爆的留学专业之一。发达国家由于税收和法律体系相对完善,法律的条文相较于其他国家而言也更加的细致和有操作性,因此,前往英、美亦或是加拿大等国攻读税法专业是一个不错的选择。

就拿美国来说吧,纽约大学和乔治敦大学一直以来都是攻读税法专业的大热学校。今天的范文就来谈谈税收筹划这个话题。由于各个国家都有自己独立的税收体系,今天我们将以加拿大2018年开始实施的Tax on Split Income(TOSI)为例来介绍如何为一个中产的加拿大家庭进行税收筹划。

TOSI的引入对很多的加拿大家庭每税务规划和税收成本的计算都产生了巨大的影响。总的来说,TOSI法则规定对于那些没有工作的人所取得的收入,比如从家族基金会取得的股票红利都适用于高税率,而对于那些有工作的人则适用低税率甚至不征税。加拿大引入该税收条款的目的是增加富裕阶层的税务负担并且保护中产阶层。但是,事实是否如此呢?我们还需要看具体的案例。

首先,我们来介绍一下今天Case :

A dentist runs his medical practice through a corporation in Nova Scotia which is owned by his Family Trust. For 2018 the following is pertinent data for the Corporation:

Corporate Taxable Income $785,000

Small Business Deduction available$500,00

Active Business Income $285,00

Dividends paid to Family trust $450,000

The client is not available for questions as he is vacationing and therefore, you may have to make some assumption in attempting to answer his questions. Please state any of these assumptions. The beneficiaries for the Family Trust include the dentist, his spouse, his 21-year-old daughter,his 19-year-old son and his 14-year-old daughter. The dentist has taken a salary of $200,000 from the corporation for 2018; none of the other family members have taxable income for 2018 or any deductions for 2018.

接下来是具体的questions:

Q1. Please determine what his corporate taxes will be for 2018 based on the data he provided?

Corporate taxes for 2018 = 500,000*3% (provincial tax) +28,5000*16%(provincial tax)+785,000*10% (federal tax) = $139,100

上面计算所用的税率参考下表

Q2. Help him in deciding how to allocate the dividends paid to his family trust and what the tax consequences would be for each of the family members based on your recommendation, which of course would be made in consideration of the new Tax on Split Income rules?

这个问题显然是比较复杂的,由于这对夫妇年龄低于65周岁,并且他们的第一和第二个孩子的年龄都大于17周岁,基于这些基本信息我们需要做一些合理的假设。假定,这两个已经在上大学的孩子都有一份兼职的工作并且平均每周工作20小时,那么每一个家庭成员基于TOSI税法准则需要具体负担的税费为:

1) The dentist:dividends or other income (such as redemption proceeds on the redemption of his preferred shares) received by the dentist will not be subject to TOSI because he was actively engaged on a regular, continuous, and substantial basis in the business in at least five prior taxation years;

2) His wife: dividends received by his spouse will be subject to TOSI and taxed at the top marginal rate (thereby eliminating any tax benefit of income splitting with her);

3) The 21-year-olddaughter: dividends received by his 21-year-old daughter will be subject to the reasonableness test to determine how much, if any, of those dividends will be subject to TOSI and taxed at the top marginal rate (thereby potentially eliminating any tax benefit of income splitting with her);

4) The 19-year-old son: dividends received by his 19-year-old son will be subject to the reasonableness test to determine how much, if any, of those dividends will besubject to TOSI and taxed at the top marginal rate (thereby potentially eliminating any tax benefit of income splitting with her);

5) The 14-year-olddaughter: dividends received by 14-year-old daughter will be subject to TOSI and taxed at the top marginal rate (thereby eliminating any tax benefit of income splitting with her);

接下来是为这个家庭提出的税收筹划建议,由于他们最小的孩子小于17周岁并且没有工作,根据TOSI规则小于17 岁的公民收到的dividend需要按照最高的税率来支付税金即45.3%,因此这个牙医需要避免让最小的孩子收到任何dividend收入。最优的方案是allocate家族基金收到的红利给自己和自己两个有兼职工作的孩子。或者,更极端的情况则是,我们假设这个家庭除了牙医本人外其他成员都不工作,那么则可以把所有$450,000 的dividend都划到男主人自己的名下,由于他有一份稳定的全职工作,则可以避免为这$450,000 的红利收入支付个人所得税。

情况1:As a result of the new TOSI rule, the dentist should allocate the dividend of $450,000 to himself, his 21-year-old daughter and his 19-year-old son to enjoy the tax benefit ofincome splitting. While allocating the dividend to his spouse and 14-year-olddaughter will lead to a marginal tax rate of 45.3%. Since the dentist has drawn salary of $200,000 from the company, he should allocate $450,000 evenly to his 21-year-old daughter and his 19-year-old son to enjoy the tax benefit.

情况2:If we assume a more extreme but also possible case that all their children are still in school and not worked an average of 20 hours per week while the business is operating; In this scenario, the physician’s spouse and their 3 children will be all subject to TOSI and taxed at the top marginal rate. Therefore, he should only allocate the dividend of $450,000 to himself.

Q3. He is scheduling a meeting with his local Member of Parliament, and to prepare for this, he is interested in what your recommendation would have been if these new rules?

Under the old rules, dividends paid by the company to the Family Trust and distributed by the Family Trust to the three children were taxed at significantly lower rates than if they had been paid to the dentist and taxed at him comparatively high rates (and in some cases the dividends were not subject to any income tax by virtue of various tax credits available to the daughters). Therefore, with the new rules, the increase in his totally family personal taxes is $450000*45.3%=$203850

Q4. He was reading that these new rules were aimed at the wealthy not the middle class, he would like some very brief comments from you as to your opinion on whether these rules are only affecting the wealthy and not the middle class, he is going to use your opinion in his discussion with the Member of Parliament, so he asked that you provide him a good understanding of why you came to such an opinion.

The new rule is not only affecting the wealthy but also affecting the middle class. At a first glance, using TOSI, the government is trying to protect the benefit of working class and the middle class as they do not have the easy access to tax saving facilities compared to the wealthy class.

However, having a second thought, this could actually achieve the opposite and hurt the benefit of middle class. With the US is currently cutting it corporate taxes, the Canadian companies/wealthy class would have the incentive to relocate to the US or shift their profit outside of Canada, as a consequence, the employment opportunities provided by these wealthy class and their company would be reduced and causing some of the middle class lose their jobs.

It is not hard to see that with the new TOSI rule, the only party that would benefit from the rule will be the tax planning professionals as people would have increasing demand for tax planning.

Q5. Finally, the dentist expects some new inputs to help him better allocate family wealth, if you have any tax planning ideas for him please include them?

Pay reasonable salaries to family members

Let his family members to get involved in the business operations (such as his wife) and leave records so that to be excluded from TOSI

Prescribed rate loan strategies

Establishing complicated pension trust such as RCA, IPP and etc.

通过对这个case的分析,同学们可以看到税收筹划对于一个家庭or企业来说是多么的重要。筹划合理可以为这个家庭大大降低税务负担,而相反则会增加这个家庭的税负。尽管每个国家的税收体系有所不同,但是世界各国所设立的税种和基于这些税种而衍生出的税收筹划的方式还是大同小异的。因此,这个加拿大税收筹划的案例应该有一定的借鉴作用。今后我们还会介绍其他国家更多不同的税务类案例,希望能给同学们提供更多的答题思路。

相关文章:

LeetCode 7. Reverse Integer

问题链接 LeetCode 7 题目解析 给定一个32位有符号整数,求其反转数字。 解题思路 如果是简单反转的话,那这道题就太简单了。题目要求判断溢出问题,32位int类型的范围是-2147483648~2147483647。数字反转过后是有可能超出范围的&am…

Ultra-QuickSort POJ 2299(归并排序)

http://acm.hust.edu.cn/vjudge/contest/124435#problem/D 题意:给出一个长度为n的数列,你每一次可以随意交换其中两个数字的位置。问你至少交换几次,才能使得这个数列是个单调递增数列。 比赛时没做出来,(自然&#x…

Geth 控制台使用及 Web3.js 使用实战

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 突然发现没有太多写实战的,所以就写一点自己的拙见,提供给成员一些参考。Geth 控制台(REPL)实现了所…

Java多线程的同步机制(synchronized)

一段synchronized的代码被一个线程执行之前,他要先拿到执行这段代码的权限,在 java里边就是拿到某个同步对象的锁(一个对象只有一把锁); 如果这个时候同步对象的锁被其他线程拿走了,他(这个线程…

mouseenter 延迟_桃园台服加速器 电狐加速器带你低延迟玩游戏

桃园是由冰动娱乐自主研发的全球首款运用世界顶级开发引擎Unreal Engine 3的次世代回合制网络游戏。Unreal 3引擎在骨骼动画树、特效渲染、游戏性完善等方面表现杰出,而且游戏中还可以呈现广角纵身大场景,1080P的高清画质将会带给玩家前所未有的视觉震撼…

私有链的特点简单介绍

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 私有链是区块链的一种,它指的是某个区块链的写入权限仅掌握在某个人或某个组织手中,数据的访问以及编写等有着十分严格的权限…

typescript调用javascript URI.js

URI.js URI.js是一个用于处理URL的JavaScript库它提供了一个“jQuery风格”的API(Fluent接口,方法链接)来读写所有常规组件和许多便利方法,如.directory()和.authority()本文以URI.j…

richeditctrl 选中ole图片 拖拽 空白_高质量的图片素材,碾压度娘几条街......

答应我不要错过哈喽大家周末好啊,总有小伙伴来问公子说每周的素材分享我到底都是从哪里找的呢,其实公子之前也有告诉过大家,可能是隔的时间太久了。所以今天呢我又给你们整理了一些经常会用到的几个图片网站,都是非常知名而且基…

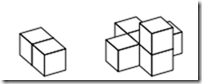

20160722noip模拟赛alexandrali

【题目大意】 有许多木块, 叠放时, 必须正着叠放, 如图1, 左边两块为合法叠放, 右边为不合法叠放. 图1 一个方块被称为稳定的, 当且仅当其放在最底层, 或其正下方有方块且下方的这个方块的四周都有方块. 叠放必须保证所有方块都稳定. 如图2, 左边3个叠放为合法叠放, 右边2个叠放…

以太坊技术知识讲解

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 以太坊(Ethereum)是2013年底由一个叫作 Vitalik Buterin 的90后小伙子提出来的技术。以太坊和比特币相似,是一个…

大数据数据倾斜

什么是数据倾斜 简单的讲,数据倾斜就是我们在计算数据的时候,数据的分散度不够,导致大量的数据集中到了一台或者几台机器上计算,这些数据的计算速度远远低于平均计算速度,导致整个计算过程过慢。 相信大部分做…

【leetcode75】Intersection of Two Arrays(数组的交集)

题目描述: 给定两个数组求他们的公共部分,输出形式是数组,相同的元素只是输出一次 例如: nums1 [1, 2, 2, 1], nums2 [2, 2], return [2]. 原文描述: Given two arrays, write a function to compute their intersec…

qprocess start怎么判断是否结束_面试结束后,如何判断自己是否有戏?看有无这8大信号!...

关注“职场沉浮宝典”,每天get一个职场小技巧面试结束后,在等待最终结果的过程中,我们常常会惴惴不安,喜欢在脑海里回放全部面试细节,多角度去判断自己通过面试的可能性。毕竟,面试就如同相亲,如…

智能合约语言Solidity 类型介绍

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 智能合约语言Solidity 类型介绍11 Solidity是以太坊智能合约编程语言,阅读本文前,你应该对以太坊、智能合约有所了解&#…

怎样快速学习React

react简单学习路线(实用版) 学习一门新的技术之前有必要了解一下该技术在专业领域的评价,使用的领域,以及整体的学习路线,总之尽可能多的在入坑之前了解相关方面的信息。不要什么都不去查就直接学了,这个是…

Poj_1274 The Perfect Stall -二分图裸题

题目:给牛找棚,每个棚只能容一只牛,牛在对应的棚才能产奶,问最多能让几只牛产奶。 /************************************************ Author :DarkTong Created Time :2016/7/31 10:51:05 File Name :Poj_1274.cpp…

青少年软件编程python考试-青岛全国青少年软件编程等级考试—Python

卓优特机器简介 卓优特机器人是集教育机器人设备研发、生产、销售及课程研发、教育机器人课程教育及竞赛技术服务、机器人实验室方案策划及配置、智能技术支持的高新技术集成服务商, 公司由多所知名大学的多位智能技术专家及教授提供技术指导。 卓优特机器人是集教育机器人设备…

区块链基础--工作量证明

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 区块链基础(6)–工作量证明1 我认为技术和共识构建了区块链,那么就由几个问题需要去解决,第一&…

pat乙级1049

浮点型乘整型和整型乘浮点型结果不同,不知为什么。 1 double sum 0.0; 2 for (int i 0; i < n; i) 3 { 4 cin >> a[i]; 5 sum a[i] * (i 1) * (n - i); 6 } 7 printf("%.2f", sum); 提交结果正确。 1 double sum 0.0; 2 for (int i…

hdu-5778 abs(暴力枚举)

题目链接: abs Time Limit: 2000/1000 MS (Java/Others) Memory Limit: 131072/131072 K (Java/Others) Problem DescriptionGiven a number x, ask positive integer y≥2, that satisfy the following conditions:1. The absolute value of y - x is minimal2. To prime f…

bugku 杂项 就五层你能解开吗_你能解开这个和数字有关的逻辑解谜游戏吗? | 每日一考...

今天是一道和数字有关的逻辑解谜游戏看看你能用多长时间得到答案这道题的目标是,把网格根据数字划分成很多个方形小块。每个数字都代表它所在的小块面积,也就是包含了几个小格子,要求如下图,每个小块里必须有,而且只能…

区块链技术术语表

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 区块链技术包含了常见的区块链基本概念和进阶阅读的参考文章,用自己的思考方式去优化理解。 比特币:一种分布式网络的数字货…

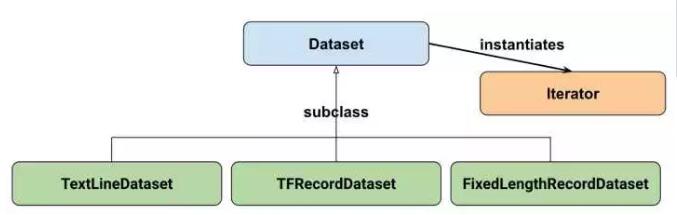

『TensorFlow』数据读取类_data.Dataset

一、资料 参考原文: TensorFlow全新的数据读取方式:Dataset API入门教程 API接口简介: TensorFlow的数据集 二、背景 注意,在TensorFlow 1.3中,Dataset API是放在contrib包中的: tf.contrib.data 而在Tenso…

出入口控制系统工程设计规范_[问答]连载77-控制系统之间如何时钟同步?

仪表小猪在控制系统中,趋势、报警、事件记录等都与时间相关,因此整个系统始终保持一个统一的时钟很关键。如果操作站和控制站时间不同步,操作员站上面显示的事件、趋势等也不能真正的反应出现场实际变化的时间,不能作为真实的历史…

分布式账本(Distributed ledger)

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 是一种在网络成员之间共享、复制和同步的数据库。分布式账本记录网络参与者之间的交易,比如资产或数据的交换。这种共享账本消除了调解不…

手动删除木马程序

1 ??? 2 这个蠢货竟然用360? (360杀毒太流氓,插件不可控,就是第一个要杀的木马) 一些基本的命令往往可以在保护网络安全上起到很大的作用,下面几条命令的作用就非常突出。 一、检测网络连接 如果你怀疑自己的计算机上被别人安装了木马,或者是中…

phpstorm如何同时打开两个文件夹_2分钟学会文件夹共享,化身办公室电脑大神

点击上方蓝色字体,关注我们身在职场或学校的你,还在用微信或QQ给办公室的小伙伴传文件吗?那你可真就out了,总结一下,微信或QQ传文件存在以下3个缺点。1、传输文件大小存在限制微信不能发送100MB以上的文件,…

Hdu_2063 过山车 -最大匹配(邻接表版)

题目:就是最大匹配了 /************************************************ Author :DarkTong Created Time :2016/8/1 12:53:27 File Name :Hdu2063.cpp *************************************************/#include <cstdio> #include <cstr…

“去中心化”为何意义重大?

链客,专为开发者而生,有问必答! 此文章来自区块链技术社区,未经允许拒绝转载。 互联网的前两个时代 在互联网的第一个时代–从20世纪80年代到21世纪初–互联网服务建立在由互联网社区控制的开放协议之上。这意味着,人…

一阶微分算子锐化图像_【动手学计算机视觉】第三讲:图像预处理之图像分割...

本讲完整代码>>前言图像分割是一种把图像分成若干个独立子区域的技术和过程。在图像的研究和应用中,很多时候我们关注的仅是图像中的目标或前景(其他部分称为背景),它们对应图像中特定的、具有独特性质的区域。为了分割目标,需要将这些…